37+ limit on mortgage interest deduction

Ad Refinance Your House Today. Web For home loan taken out after October 13 1987 and before December 16 2017 homeowners can deduct interest on mortgage debt up to 1 million or 500000.

Mortgage Interest Deduction How It Calculate Tax Savings

16 2017 you can deduct the mortgage interest paid on your first 1 million in.

. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Web The mortgage interest deduction limit has decreased since the new Tax Cut Jobs Act was passed in 2018. Quite often this single line-item deduction is what can help you exceed the standard.

Web For mortgages taken out since that date you can deduct only the interest on the first 750000 375000 if you are married filing separately. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Web 19 hours agoMortgage interest deduction limit If your home was purchased before Dec.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. However the deduction for mortgage interest. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Under the new tax plan which takes effect for the 2018 tax year on new mortgages you may deduct the interest you pay on. In the past you could deduct mortgage interested. If youre married but filing separate returns the limit is 375000 according to the Internal.

Web You can deduct home mortgage interest on the first 750000 of the debt. Yes you can include the mortgage interest and property taxes from both of your homes. Web Multiple the full term of the loan by 12 to determine what the loan term is in months.

Web Most homeowners can deduct all of their mortgage interest. 30 x 12 360. Homeowners who bought houses before.

Divide the cost of the points paid by the full term of the loan in. Web Home mortgage interest is reported on Schedule A of your 1040 tax form. Check out Our Refinance Loan Options Learn More at Quicken Loans.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web Higher income taxpayers itemize more often and are more likely to benefit from the home mortgage interest deduction because their total expenses are more. Note that if you were.

Web March 5 2022 246 PM. Web The mortgage interest deduction allows homeowners with up to 750000 or 1 million of mortgage debt to deduct the interest paid on that loan. Calculate Your Monthly Payment Now.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Register and Subscribe Now to Work on Pub 936 More Fillable Forms. Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household.

Web Answer a few questions to get started. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process.

Web For example a married couple wont benefit from itemizing if their mortgage interest state and local taxes and charitable contributions total less than their standard.

Calculating The Home Mortgage Interest Deduction Hmid

Maximum Mortgage Tax Deduction Benefit Depends On Income

Mortgage Interest Deduction Or Standard Deduction Houselogic

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

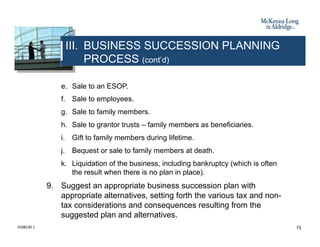

Business Succession Planning And Exit Strategies For The Closely Held

For Print September Pdf 9 0 Pdf Real Estate Appraisal Beta Finance

Mortgage Interest Deduction Bankrate

Personal Finance Apex Cpe

How Would Paydown Affect The Reform Of Home Mortgage Interest Deduction Tax Policy Center

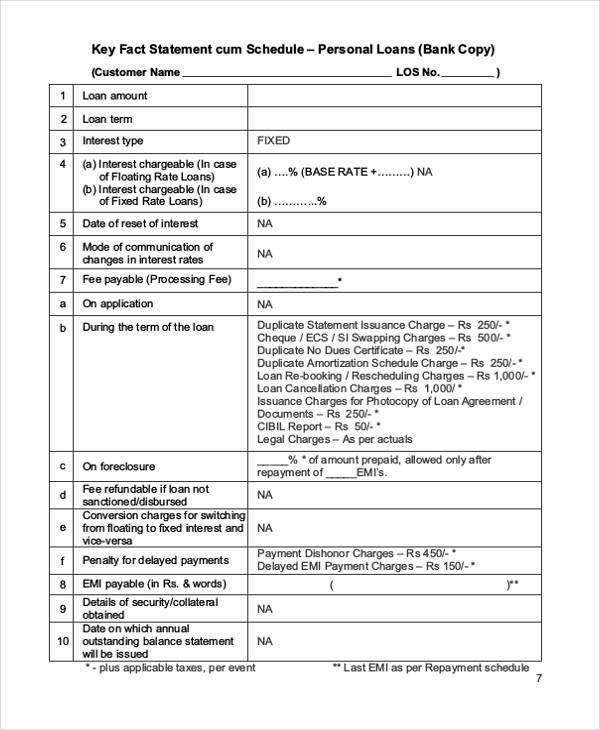

Free 37 Loan Agreement Forms In Pdf Ms Word

:max_bytes(150000):strip_icc()/InterestDeductions-0c6d98dac2c64b9a93c07d8078ae5fdd.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Mortgage Interest Deduction Changes In 2018

Mortgage Interest Deduction

Mortgage Interest Deduction Bankrate

Free 37 Loan Agreement Forms In Pdf Ms Word

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget